新華社英文網站在其最新的評論指出,中國不會采取激進的貨幣寬松政策,直到經濟出現實質性的改變。激進的存款準備金率寬松和降息不僅會引起流動性過剩,也會抑制中國減少產能過剩和刺破資產泡沫的努力。

- 中國央行通過公開市場操作調整了流動性,其使用的工具包括逆回購和其它幾個貸款渠道。迄今為止,這些措施在保證足夠貨幣供應和維護穩定利率方面起到了效果。積極的財政政策和穩健的貨幣政策也促進了中國經濟的增長。因此,中國沒有理由改變當前的貨幣政策方向。

以下是英文原文:

#CHINA-RMB VALUE-WEAK (CN)

A bank staff member checks RMB banknotes at a bank in Lianyungang, east China's Jiangsu Province, Jan. 7, 2016. (Xinhua file photo/Si Wei)

by Xinhua writer Liu Xinyong

BEIJING, Aug. 10 (Xinhua) -- Despite having a range of monetary levers at its disposal, China's central bank is taking a careful and considered approach to using them.

Since the beginning of the year, the People's Bank of China (PBOC), the country's central bank, has lowered the reserve requirement ratio (RRR) just once, compared with five RRR cuts and five interest rate cuts in 2015.

Market anticipation for more cuts is rising as moderate consumer inflation in July offered sufficient room for such maneuvers, especially after the Bank of England slashed its interest rates to a record low last week.

Those hoping for cuts, however, will probably be disappointed.

The PBOC is unlikely to resort to frequent RRR and interest rate cuts in the second half of the year as it has consistently reiterated the need for prudent monetary policy to create a neutral monetary environment.

It is also fully aware of the negative effects of such moves, associating repeated RRR cuts with an easing of monetary policy, falling interest rates and depreciation pressure of Renminbi, the Chinese currency or the yuan.

The yuan's central parity rate against the U.S. dollar has weakened by more than 2 percent this year, and further depreciation pressures still exist, partly due to the strength of the dollar after Brexit.

Instead of directly increasing liquidity, the PBOC has adjusted liquidity through open market operations, with tools including reverse repos and several types of lending facilities.

So far, these measures have proved effective in ensuring a sufficient money supply, maintaining steady interest rates and sustaining sound economic growth.

China's mix of proactive fiscal policy and prudent monetary policy contributed to 6.7 percent year-on-year GDP growth in the second quarter, the lowest growth rate since early 2009 but still the envy of many countries.

The quality of China's economic growth is also improving, with rapid growth in the service sector, growth in consumption, encouraging data on new company registration, and a booming high-tech sector.

With the new changes, it is fair to say that China's macroeconomic policies are having the desired effecAggressive easing of the RRR and interest rate cuts will not only cause excessive liquidity but also dampen China's efforts to reduce overcapacity and squeeze out asset bubbles.

With current practices proving effective, there is no reason for the PBOC to change course.

Accordingly, it is unlikely that China will resort to any aggressive easing of monetary policy until there are substantial changes in the economy.t and that the country should ensure policy continuity and stability.

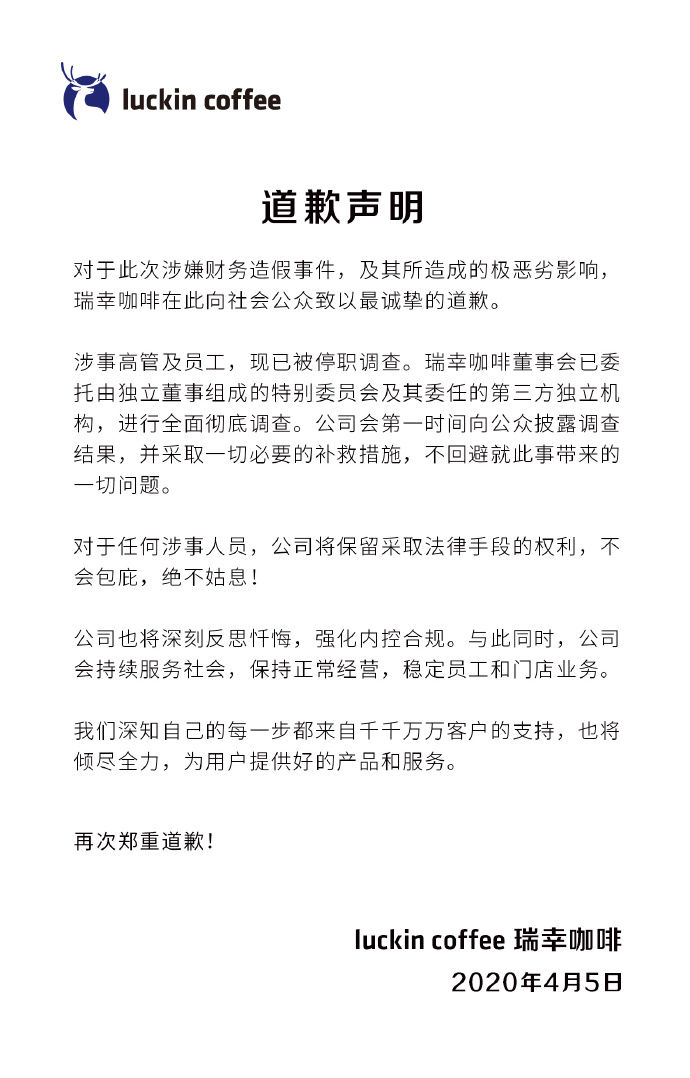

瑞幸咖啡就財務造假事件致歉

瑞幸咖啡就財務造假事件致歉

重磅利好出現!金融委再度定

重磅利好出現!金融委再度定

國產耳機品牌Nank南卡重拳出

國產耳機品牌Nank南卡重拳出

比特幣年內漲幅超過150% 中

比特幣年內漲幅超過150% 中

中興通訊科技公司將投資146

中興通訊科技公司將投資146

寧夏靈武農商銀行一董事又“

寧夏靈武農商銀行一董事又“

打通企業營銷困局 時刻頭條

打通企業營銷困局 時刻頭條

2017年我國汽車產銷量同比增

2017年我國汽車產銷量同比增